You’ve just graduated from UP, hooray! Your required math, science, history, English and various social science classes have shaped you into a well-rounded professional. But when that first paycheck rolls in, what do you do with it?

Do you put it all into savings or a checking account? Do you invest it? Your boss is talking about something called a 401k match, but what’s that? It seems that one crucial element of your education has been left untaught: financial literacy.

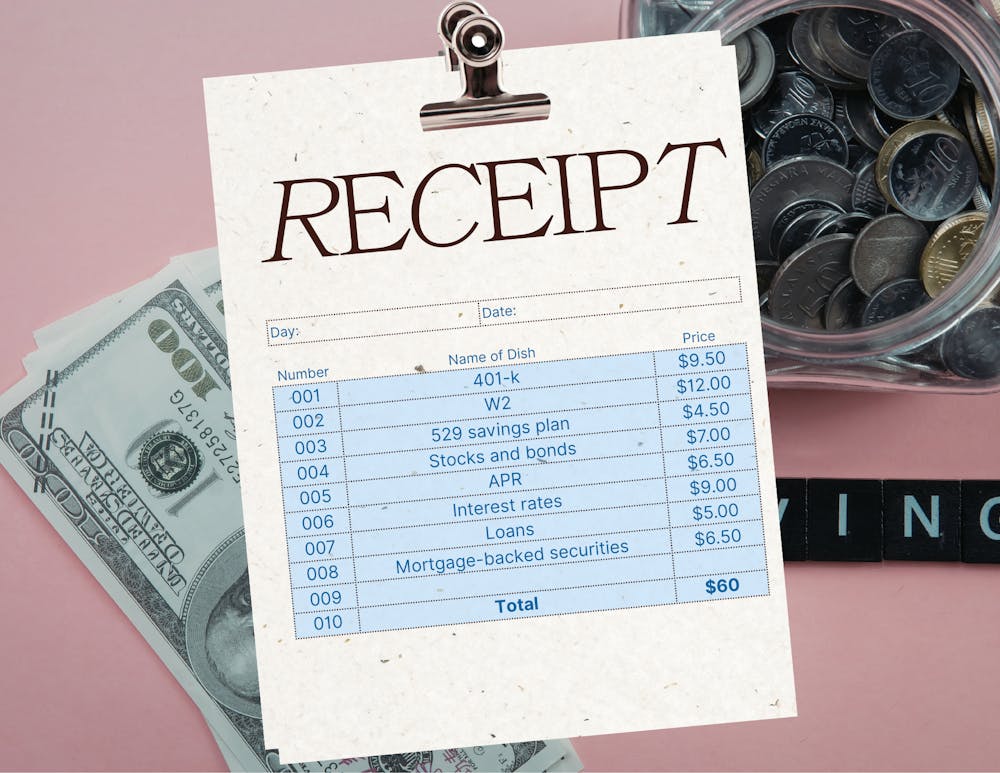

By requiring all students take BUS 205: Foundations of Finance, UP can change that. In BUS 205, students not only learn about corporate finance and how companies invest their money, but personal finance. Here, students learn how they can save and plan for their future, calculate their retirement income and invest throughout their professional lives.

Currently, UP only requires students in the School of Business to take a fundamental finance course. But to me, that seems a little short sided. This class isn’t about a niche topic like “Brand Design” or “British Literature,” it is universally applicable to all career paths.

And as our school leaves this subject untaught, so do many others. American adults appear to be faltering, with financial literacy rates dropping for the first time in eight years, from 50 to 48%, according to the World Economic Forum.

By requiring a class that introduces students to the fundamentals of financial literacy, UP can better prepare young adults for the post-grad world. This doesn’t just mean retirement though. Finance classes can help students understand how their credit works, how to understand the economic climate and how to save for bigger investments like a house, a boat, a house boat.

And bonus: This knowledge has more than a singular impact. A study through Science Direct found that peers share the information they learn with one another, meaning that one person’s financial literacy can ripple throughout their community and beyond.

By integrating BUS 205 into the university core, UP would better support students towards a healthy financial future. Interested in testing your knowledge? Click here to take the “Big Three” personal finance quiz.

Nandita Kumar is the Community Engagement Editor for The Beacon. She can be reached at kumarn27@up.edu.

Have something to say about this? We’re dedicated to publishing a wide variety of viewpoints, and we’d like to hear from you. Voice your opinion in The Beacon.